Hsmb Advisory Llc for Beginners

Table of ContentsThe Hsmb Advisory Llc IdeasExamine This Report on Hsmb Advisory LlcHsmb Advisory Llc Can Be Fun For EveryoneHow Hsmb Advisory Llc can Save You Time, Stress, and Money.

Life insurance coverage is especially crucial if your family members hinges on your salary. Sector experts recommend a plan that pays out 10 times your annual earnings. When approximating the quantity of life insurance policy you require, element in funeral expenditures. Then compute your family's daily living costs. These may include home mortgage repayments, superior loans, charge card financial obligation, tax obligations, youngster treatment, and future university prices.Bureau of Labor Statistics, both spouses functioned and brought in earnings in 48. They would certainly be most likely to experience monetary hardship as an outcome of one of their wage earners' deaths., or exclusive insurance policy you purchase for on your own and your family by contacting wellness insurance companies straight or going through a wellness insurance policy agent.

2% of the American populace lacked insurance policy protection in 2021, the Centers for Illness Control (CDC) reported in its National Facility for Health Statistics. Even more than 60% obtained their coverage through an employer or in the personal insurance marketplace while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' benefits programs, and the government marketplace developed under the Affordable Care Act.

The 5-Minute Rule for Hsmb Advisory Llc

If your revenue is reduced, you may be one of the 80 million Americans who are qualified for Medicaid.

According to the Social Safety and security Administration, one in four workers going into the workforce will come to be handicapped before they reach the age of retired life. While wellness insurance pays for a hospital stay and medical bills, you are commonly burdened with all of the expenses that your paycheck had covered.

This would certainly be the best option for securing economical disability protection. If your company doesn't use long-term coverage, right here are some things to consider before purchasing insurance coverage by yourself: A policy that guarantees earnings replacement is ideal. Numerous policies pay 40% to 70% of your income. The price of special needs insurance is based on lots of factors, consisting of age, way of life, and health and wellness.

Lots of plans call for a three-month waiting period prior to the protection kicks in, give an optimum of 3 years' worth of insurance coverage, and have significant policy exemptions. Below are your alternatives when purchasing auto insurance coverage: Liability protection: Pays for residential property damages and injuries you create to others if you're at fault for a crash and additionally covers lawsuits prices and judgments or settlements if you're filed a claim against because of an automobile mishap.

Comprehensive insurance policy covers burglary and damage to your vehicle as a result of floods, hail, fire, vandalism, dropping items, and pet pop over to this web-site strikes. When you finance your vehicle or lease a car, this type of insurance is mandatory. Uninsured/underinsured motorist () coverage: If a without insurance or underinsured driver strikes your vehicle, this insurance coverage spends for you and your guest's medical expenditures and might likewise represent lost income or compensate for pain and suffering.

Company protection is frequently the most effective choice, yet if that is unavailable, obtain quotes from a number of carriers as lots of offer price cuts if you buy even more than one type of insurance coverage. (http://peterjackson.mee.nu/where_i_work#c2063)

What Does Hsmb Advisory Llc Do?

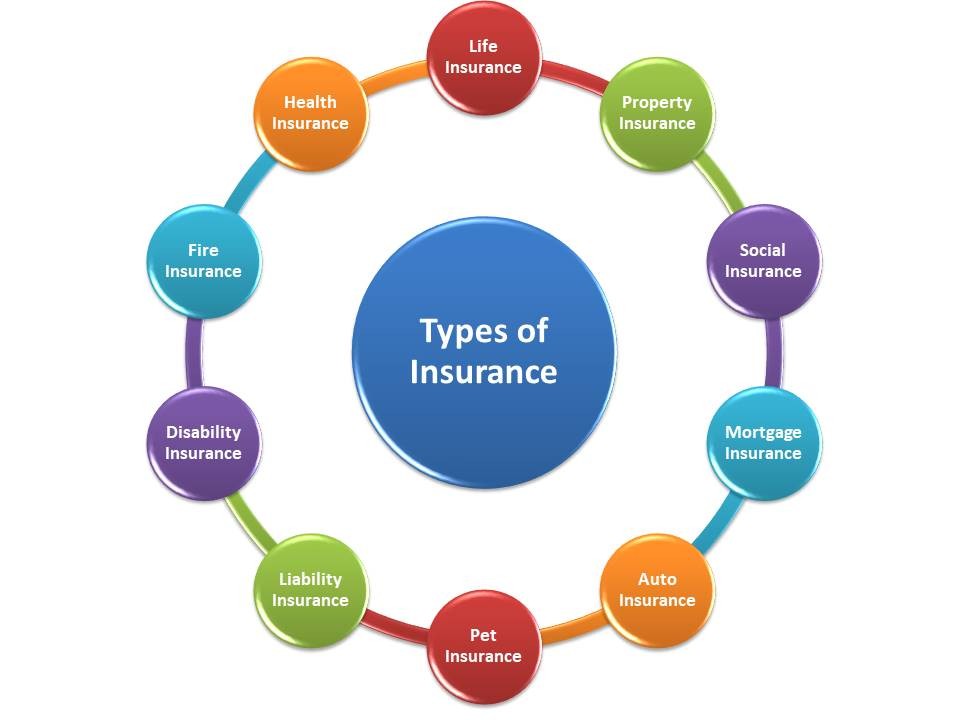

In between medical insurance, life insurance policy, impairment, liability, long-lasting, and also laptop insurance, the task of covering yourselfand thinking of the unlimited opportunities of what can happen in lifecan really feel overwhelming. Once you understand the principles and make sure you're sufficiently covered, insurance policy can enhance financial confidence and well-being. Right here are the most crucial sorts of insurance policy you require and what they do, plus a pair tips to avoid overinsuring.

Different states have different policies, yet you can anticipate health and wellness insurance coverage (which lots of people get with their company), automobile insurance coverage (if you have or drive a car), and home owners insurance policy (if you possess home) to be on the listing (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1708930655&direction=prev&page=last#lastPostAnchor). Obligatory kinds of insurance can transform, so inspect up on the latest laws every now and then, especially before you renew your policies